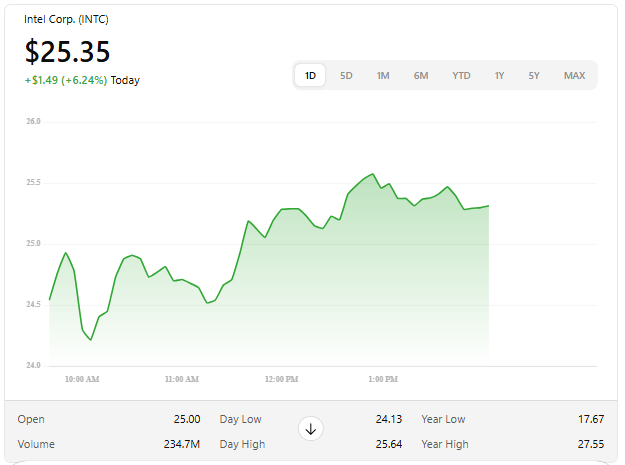

Reuters reports indicate that on the 15th of August, the following occurred: With the assumption that greater financial support will be offered for the recovery of the ailing chipmaker, shares of Intel (INTC.O), which opens a new tab, surged by more than four percent on Friday. This was due to the fact that the expectation that additional financial aid will be provided. This action, which was carried out in reaction to the rumor, was spurred by a report that suggested the government of the United States of America may purchase an interest in the firm.

Trump Orders Intel CEO to Resign Over Ties to Chinese Firms Amid Strategic Rare-Earth Deal

As a result of a meeting that took place between President Donald Trump and CEO Lip-Bu Tan, the accusation was formally made public by Bloomberg News on Monday. The meeting took place. President Trump has issued an order for the recently appointed Intel chief to resign from his post. The reason for this order is because the newly appointed Intel chief has “highly conflicted” relationships with Chinese enterprises at the moment.

One example of the unique approach that President Trump has taken regarding corporate incursions is a deal that would make the Department of Defense the largest stakeholder in the rare-earth producer MP Materials (MP.N). This contract would be an example of the unprecedented strategy that President Trump has adopted that has been taken. This tactic is also the one that President Trump has utilized in his administration. In his remarks, Trump referred to the meeting as “very interesting,” and he has continued to use an approach that is fairly like to the one he is currently using.

Trump Administration Weighs Intel Stake Purchase Using 2022 CHIPS Act Funds

According to a report that was published by Bloomberg News on Friday, which cited individuals who are involved with the conversations, the administration of President Trump is reportedly considering the possibility of acquiring a share in Intel by utilizing cash from the 2022 CHIPS Act, which was enacted by his predecessor, Joe Biden. The CHIPS Act was enacted in 2022. The year 2022 saw the passage of the CHIPS Act. This particular piece of information was mentioned in the report at some point.

Intel’s $8B Subsidy Plans Face Delays Under CEO Lip-Bu Tan, Raising Concerns Over U.S. Industrial Goals

Intel was awarded almost $8 billion in subsidies over the previous year, which was the largest amount of money that was spent in compliance with the legislation. The firm was able to establish new factories in Ohio as well as in other states by making use of these advantages, which allowed them to do so. Pat Gelsinger, who had previously served as the Chief Executive Officer of the company, had established his expectations regarding these subsidies. He was of the idea that they would assist the company in regaining its industrial dominance, and he had set his expectations accordingly.

Tan, on the other hand, lowered such goals, which led to a prolonged delay in the process of expansion in the state of Ohio for a considerable amount of time. It has been hypothesized by analysts that he might be in conflict with the efforts that President Trump is doing to strengthen the industrial sector in the United States. This is as a result of the fact that he plans to build factories in accordance with the demand for the services. This is due to the fact that he intends to create industrial facilities in the near future.

The White House and Intel did not provide a fast response to the demands for comment that were made by Reuters. Reuters inquired about the situation. These two organizations did not provide a response to the requests for comment that were made.

Intel Faces Product Pipeline Struggles as Analysts See U.S. Aid as Potential Game-Changer

There are still issues with Intel’s product pipeline, and the company is having trouble acquring clients for expanding its manufacturing facilities. Analysts, on the other hand, are of the opinion that the assistance provided by the federal government could give the corporation more time to restore its foundry sector, which is currently operating at a loss. Despite the fact that Intel is currently experiencing difficulties with these issues, this is the current state of affairs on the matter.

A senior stocks analyst at Hargreaves Lansdown named Matt Britzman is of the opinion that something like to this has the potential to be a “game-changer.” Britzman is of this opinion; he works for Hargreaves Lansdown. He nevertheless voiced the perspective that “government support might help shore up confidence, but it doesn’t fix the underlying competitiveness gap in advanced nodes.”causes a new tab to appear Over the course of several years, the Taiwanese semiconductor company TSMC (2330.TW) has been able to establish a competitive advantage over Intel, which has resulted in the opening of a new tab.

At the same time as it is losing market share in personal computers and datacenters to AMD (AMD.O), opens a new tab, it has virtually no presence in the rapidly expanding market for artificial intelligence processors, which is dominated by Nvidia (NVDA.O). This is because AMD is the market leader in both of these areas. Due to the fact that AMD is the market leader in both of these sectors, this is the case. This is the situation that exists as a result of the fact that AMD is the market leader in both of these various categories.

Intel’s 18A Chip Production Faces Quality Issues, Analysts Question U.S. Support Impact

There have been reports from Reuters indicating that the most recent 18A production technique that the business has utilized appears to be having quality issues. The firm continues to rely on TSMC for the production of chips that are manufactured locally by Intel. This is because of the aforementioned reason. This is as a result of the fact that only a small percentage of the chips that are created offer sufficient performance to meet the requirements of the users.

“Intel also needs capability; can the US government do anything to help here?” Analysts working for Bernstein were the ones who communicated the statement.

“Without a solid process roadmap the entire exercise would be economically equivalent to simply setting 10s of billions of dollars on fire.”

During the time that Rashika Singh and Arsheeya Bajwa were assigned to Bengaluru, Alun John was in charge of reporting from London. During this time period, Rashika established her home in the city of Bengaluru. The document was edited by Jan Harvey, Rashmi Aich, and Arun Koyyur, who were the individuals responsible for the editing process.

1. Why did Intel stock go up?

Intel’s stock rose recently after reports suggested the U.S. government may consider acquiring a stake in the company using funds from the 2022 CHIPS Act. Investors anticipate that increased federal support could strengthen Intel’s manufacturing capabilities and help it regain competitiveness in the semiconductor market.

2. Is Intel over or undervalued?

Analyst opinions vary. Some see Intel as undervalued due to its long-term potential and government support prospects, while others believe the stock reflects the company’s ongoing struggles with product delays, quality issues, and market share loss to rivals like TSMC and AMD.

3. How much equity does Intel have?

As of the most recent financial reports, Intel holds tens of billions in total equity, bolstered by assets from its manufacturing facilities and government subsidies. However, its foundry business is currently operating at a loss, impacting overall profitability.

4. How high will Intel stock go?

Stock price targets depend on execution. If Intel can fix its production pipeline issues and leverage U.S. government aid effectively, analysts believe the stock could see significant upside. However, persistent competitiveness gaps in advanced chip nodes could limit gains.

5. Did Intel stock climb 12% in two days?

No, Intel’s recent surge was over 4% in a single day following U.S. government stake purchase speculation. While the stock has seen larger rallies in past years, the current movement reflects investor optimism about federal involvement.

6. Will Intel ever bounce back?

Intel has the potential to bounce back, especially with CHIPS Act funding, strategic partnerships, and new factory projects in Ohio and other states. Success will depend on resolving manufacturing delays and closing the technology gap with TSMC.

7. Is Intel losing market share?

Yes, Intel has been losing market share in advanced semiconductor manufacturing to TSMC and AMD over recent years, particularly in high-performance computing and AI chips.

8. Is Intel a takeover target?

While large-scale acquisitions of Intel are unlikely due to its size, strategic stake purchases—such as the rumored U.S. government investment—are possible. This would be more about national security and supply chain control than a typical corporate buyout.

9. Who is most likely to buy Intel?

The most likely “buyer” in the near term, if any, would be the U.S. government acquiring a partial stake for strategic and economic reasons. A full corporate takeover by another tech company is highly improbable given Intel’s scale and regulatory hurdles.

10. Is Intel stock heavily shorted?

Intel is not among the most heavily shorted tech stocks. While some investors have short positions due to concerns about competition and delays, the short interest remains moderate compared to more volatile tech names.

TOP FAQS —

1. Will Intel ever bounce back?

Intel has the potential to recover, especially with U.S. government support under the CHIPS Act and strategic investments in new manufacturing plants. However, it must close its technology gap with rivals like TSMC and AMD to fully regain dominance.

2. Is Intel losing market share?

Yes. Over the past decade, Intel has steadily lost market share to TSMC in manufacturing and to AMD in CPU performance. AI chipmakers like NVIDIA are also eroding Intel’s position in high-growth sectors.

3. What will replace Intel?

In some markets, AMD and TSMC are already replacing Intel as leaders in performance and manufacturing. For AI and data centers, NVIDIA has become the preferred choice. However, Intel remains a key player in certain PC and server segments.

4. Should I invest into Intel?

Investing in Intel carries both opportunity and risk. It may be undervalued compared to its historical highs, and government support could boost growth—but ongoing production delays and competitiveness issues remain major concerns.

5. Does Intel have a chance of recovery?

Yes, but recovery depends on fixing manufacturing issues, improving advanced chip nodes, and executing its roadmap. Without these improvements, market share losses may continue.

6. How much trouble is Intel in?

Intel is in a challenging position with shrinking market share, quality issues in its 18A process, and stronger competitors. However, its size, cash reserves, and political importance give it a safety net.

7. Is Intel crash fixed?

If referring to the stock’s multi-year decline, no—it hasn’t fully recovered. Short-term rallies have occurred, but long-term performance is still well below its peak.

8. How high will NVIDIA stock go in 2025?

Analysts project NVIDIA could see continued growth in 2025 driven by AI demand, but exact targets vary widely, with some predicting it could surpass $1,000 if growth trends continue.

9. Is NVIDIA overvalued?

Some analysts believe NVIDIA’s valuation is high relative to current earnings, driven by investor optimism in AI. Others argue its dominance in AI chips justifies the premium.

10. How much will NVIDIA shares cost in 2030?

Long-term predictions are speculative, but if NVIDIA maintains AI leadership, shares could be significantly higher than today. Many forecasts range from moderate growth to several times its current price.

11. Can NVIDIA reach 200?

NVIDIA already trades well above $200, so this is no longer a future milestone—it passed that level years ago.

12. Is NVIDIA buying Intel?

No credible reports suggest NVIDIA plans to acquire Intel. Regulatory and size barriers make such a deal extremely unlikely.

13. Is NVIDIA replacing Intel?

In AI and certain high-performance computing markets, NVIDIA is taking market share once held by Intel. However, Intel still leads in some CPU and PC segments.

14. Does Intel have any future?

Yes. Intel remains a major semiconductor manufacturer with global influence. Its future depends on successfully modernizing production and winning back customers.

15. Will the government let Intel fail?

Unlikely. Intel is strategically important for U.S. technology and defense supply chains. Government aid—like CHIPS Act funding—aims to ensure it remains competitive.

16. Is it smart to invest in Intel?

It can be, if you believe in its turnaround potential and long-term role in U.S. semiconductor manufacturing. However, risks from competition and execution missteps remain high.

17. Can Intel have a comeback?

Yes, but only if it executes its technology roadmap, improves chip quality, and leverages government partnerships to regain market confidence.