The Reason Behind Beyond Meat Stock’s (BYND)

Even though the firm that makes a plant-based meat substitute didn’t provide any news on Monday, Beyond Meat’s stock (BYND +46.00%) ▲ skyrocketed higher. The reason for today’s increase in BYND stock is not explained by any recent news releases or filings with the Securities and Exchange Commission (SEC).

What Beyond Meat Is?

Beyond Meat, Inc. (NASDAQ: BYND) is a top plant-based meat company that makes a range of groundbreaking plant-based meats from basic ingredients. These meats have no GMOs, added hormones or antibiotics, and 0mg of cholesterol per serving. Beyond Meat started in 2009. Their products are meant to taste and feel like animal-based meat, but they are better for people and the environment. Eat What You Love® is Beyond Meat’s brand promise. It shows that they strongly believe there is a better way to feed our future and that even tiny positive choices we all make may have a big effect on our own health and the health of the planet. We can help four big global problems become better by switching from animal-based meat to plant-based protein. These problems are climate change, human health, limits on natural resources, and animal welfare.

That does not, however, imply that the company’s stock has surged without cause.

Benefit from 50% off Tip Ranks Premium! To help you invest with confidence, get cutting-edge data, strong investing tools, and knowledgeable analyst insights.

Rather, the stock of Beyond Meat seems to be the object of a short squeeze. There are 76.75 million outstanding shares of BYND stock, with 63.25 million shares in circulation. With a short percentage of outstanding shares at 51.58% and a short percentage of float at 54.01%, the company’s stock is likewise heavily shorted. Based on data from the previous month, investors will observe that around 31.12 million shares of BYND stock are shorted.

It makes natural that Beyond Meat would be the subject of a short squeeze given the large level of short interest. When short sellers are compelled to purchase shares they have borrowed, this is known as a short squeeze. In order to cover their holdings, they must repurchase shares, which raises the stock price in tandem with intense trading.

Today’s Beyond Meat Stock Movement

After a 24.15% increase on Friday, Beyond Meat’s stock was up 58.77% in pre-market trading on Monday. Still, the stock has lost 89.74% over the last 12 months and 82.83% so far this year.Over 129 million shares of Beyond Meat’s stock were exchanged today, indicating that the company saw high trading activity as well. That is significantly more than the company’s average of 39.05 million units each day over the last three months.

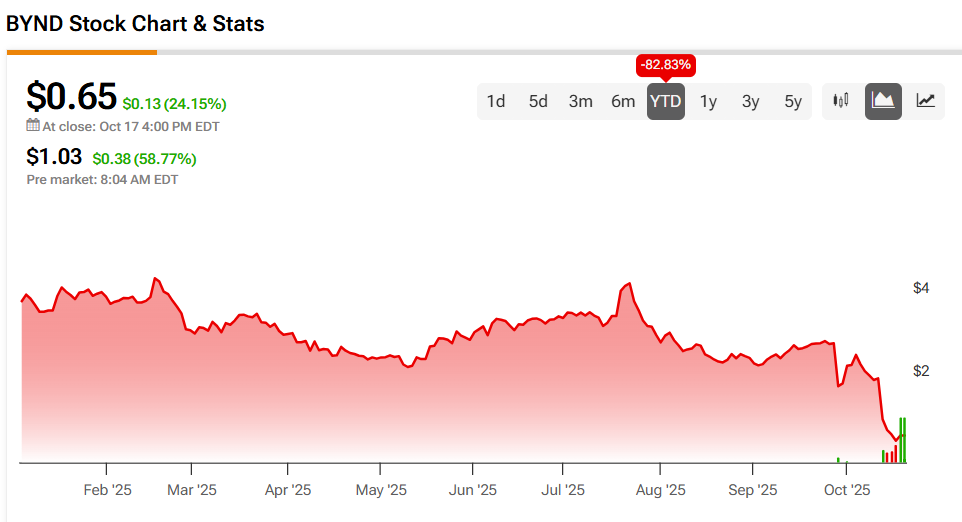

Trend Analysis (YTD)

- BYND stock has been in a persistent downtrend throughout 2025.

- The stock started the year around $3.80–$4.00, and by October 2025, it dropped below $1.00, marking an 82% decline YTD.

- Occasional small rallies occurred (notably around July–August 2025), but these were short-lived before continuing the downward trajectory.

- The steepest decline happened between late September and early October 2025, when the price plummeted from roughly $2 to below $0.70.

Overview

- Closing price (Oct 17, 2025): $0.65

- Change: +24.15% on the day (+$0.13)

- Pre-market (Oct 18, 2025, 8:04 AM EDT): $1.03, up +58.77% from the previous close

- Year-to-date (YTD) performance: -82.83%

Should I buy, sell, or hold Beyond Meat stock?

Based on three Hold and five Sell ratings over the previous three months, the analysts’ consensus rating on Wall Street for Beyond Meat is Moderate Sell. Along with that comes an average target price of $2.20 for BYND stock, which could increase the value of the shares by 240.77%.

Beyond Meat says that at 5:00 PM New York City time, the lock-up restrictions on shares that were exchanged for existing convertible notes in its exchange offer will end.

October 16, 2025, in El Segundo, California (GLOBE NEWSWIRE) — Beyond Meat, Inc. (NASDAQ: BYND) (the “Company” or “Beyond Meat”), a leader in plant-based meat, today announced that the lock-up restrictions that applied to certain of the 316,150,176 shares of its common stock (the “New Shares”) that were issued on October 15, 2025, in connection with the Company’s exchange offer (the “Exchange Offer”) for its 0% Convertible Senior Notes due 2027 (the “Existing Convertible Notes”) will expire as of 5:00 p.m., New York City time, on the date hereof.

By giving Existing Convertible Notes in the Exchange Offer, each holder of Existing Convertible Notes who took part was thought to have agreed with the Company that from the Early Settlement Date until 5:00 p.m. New York City time on October 16, 2025,

it would not transfer, sell, exchange, assign, or convey any legal or beneficial ownership interest in, or any right, title, or interest in, or any right or power to vote, or otherwise dispose of (whether by sale, liquidation, dissolution, dividend, distribution, or otherwise) any New Shares, or enter into any contract, option, or other agreement with respect to any of the foregoing; provided that an exchanging holder of Existing Convertible Notes was permitted to sell up to approximately 37.45% of the New Shares received by such holder in the Exchange Offer (the “Freely Tradeable Shares”).

The lock-up restrictions mentioned above end today at 5:00 p.m. New York City time.

The lock-up restrictions mentioned above end today at 5:00 p.m. New York City time. After that, anyone who own New Shares will be able to sell any and all of the New Shares they got in the Exchange Offer without the restrictions that the lock-up clauses put in place. The New Shares were issued into a Contra CUSIP (CUSIP NO. 088ESCAA6) to keep anyone from trading them during the lock-up period, save for the Freely Tradeable Shares. It is expected that the new shares that are subject to the Contra CUSIP will be put into the unrestricted CUSIP for the Company’s common stock (CUSIP NO. 08862E109) on October 17, 2025, following the rules set by the Depository Trust Company (“DTC”) and its participants.

The Exchange Offer only lets holders of Existing Convertible Notes who are (i) “qualified institutional buyers” as defined in Rule 144A of the Securities Act or (ii) “accredited investors” as defined in Rule 501(a) of the Securities Act who own at least $200,000 in Existing Convertible Notes.

The Exchange Offer does not register the New Shares or any other securities with the Securities Act of 1933, as amended, or any other securities laws. This press release does not offer to sell or ask for an offer to buy the New Shares, the Existing Convertible Notes, or any other securities offered in the Exchange Offer. It also does not mean that these securities or any other securities will be sold in any state or other jurisdiction where such an offer, sale, or request would be against the law.

Forward-Looking Statements from Beyond Meat

Some of the information in this release are “forward-looking statements” under federal securities laws. Management’s current thoughts, hopes, beliefs, plans, goals, assumptions, or forecasts about what will happen in the future or what will happen in the future are the basis for these statements. Statements about the limitations on the New Shares and the distribution of the unrestricted CUSIP relating to the New Shares according to the rules of DTC and DTC participants are examples of forward-looking statements. These comments about the future are only guesses, not facts from the past, and they come with certain dangers and unknowns, as well as some assumptions. The actual results, levels of activity, performance, achievements, and events could be very different from what these forward-looking statements say, expect, or suggest.

Beyond Meat thinks its assumptions are acceptable, but it’s very hard to guess how known factors would affect real results, and of course, it’s impossible to guess all the elements that could affect actual results. There are a lot of risks and unknowns that could make the actual results very different from what is said or implied in this document. These include risks related to Beyond Meat’s ability to get the expected benefits from the Exchange Offer and Consent Solicitation, as well as the risks listed under “Risk Factors” in Beyond Meat’s Annual Report on Form 10-K for the fiscal year that ended on December 31, 2024, which was filed with the U.S. Securities and Exchange Commission (“SEC”) on March 5, 2025;

Beyond Meat’s Quarterly Report on Form 10-Q for the fiscal quarter that ended on March 29, 2025, which was filed with the SEC on May 8, 2025; Beyond Meat’s Quarterly Report on Form 10-Q for the fiscal quarter that ended on June 28, 2025, which was filed with the SEC on August 8, 2025; and Beyond Meat’s Current Report on Form 8-K filed with the SEC on October 6, 2025, as well as other factors that are described in Beyond Meat’s filings with the SEC from time to time.

These kinds of forward-looking statements are only true as of the date of this release. Beyond Meat is not obligated by law to publicly update or change any forward-looking statement because of new information, future events, or anything else. If Beyond Meat modifies one or more of its forward-looking statements, you shouldn’t assume that the company will make subsequent adjustments to those or other forward-looking statements.